UK Financial Regulations and Professional Integrity

Master the essential principles of UK financial regulations and the critical importance of professional integrity. This course equips you with the knowledge to navigate compliance, mitigate risks, and uphold ethical standards—empowering you to excel in a regulated industry and build trust as a distinguished financial professional.

Enquire Today! +44 20 8129 4023

Flawlessly Refining Careers

The UK Regs

The UK Financial Regulations and Professional Integrity course focuses on the core principles of ethics, integrity, and accountability that are fundamental to the financial services sector. In a profession where trust and transparency are paramount, adhering to the highest ethical standards is not just an expectation but a necessity for maintaining market confidence and protecting consumers.

This course delves into the critical importance of professional integrity, highlighting the role of ethical behavior in fostering a culture of trust and reliability. Participants will gain an in-depth understanding of key topics such as whistleblowing, regulatory compliance, and ethical decision-making, which are essential in identifying and addressing misconduct within the industry. By exploring these principles, learners will better understand how to navigate complex scenarios and maintain their professional standing.

Additionally, the course examines the UK’s regulatory landscape, shedding light on the policies and frameworks that underpin financial services. It highlights the importance of adhering to these regulations to ensure market integrity and stability. Through practical insights and case studies, participants will learn to apply these principles in real-world contexts, equipping them to manage ethical dilemmas and regulatory challenges effectively.

Whether you are a newcomer to the financial industry or an experienced professional seeking to strengthen your knowledge, this course offers valuable insights into the ethical responsibilities and regulatory expectations of the sector. By completing this program, you will be well-prepared to uphold the integrity and professionalism that define successful financial practitioners.

Why Choose the UK Regs?

- Comprehensive Curriculum: A deep dive into UK financial regulations, investment risk management, taxation, and derivatives.

- Practical Expertise: Learn actionable strategies to optimise returns, mitigate risks, and safeguard client assets.

- Industry-Recognised Certification: Equip yourself with a globally respected credential to elevate your career.

- Commitment to Professionalism: Build trust through adherence to ethical and regulatory standards.

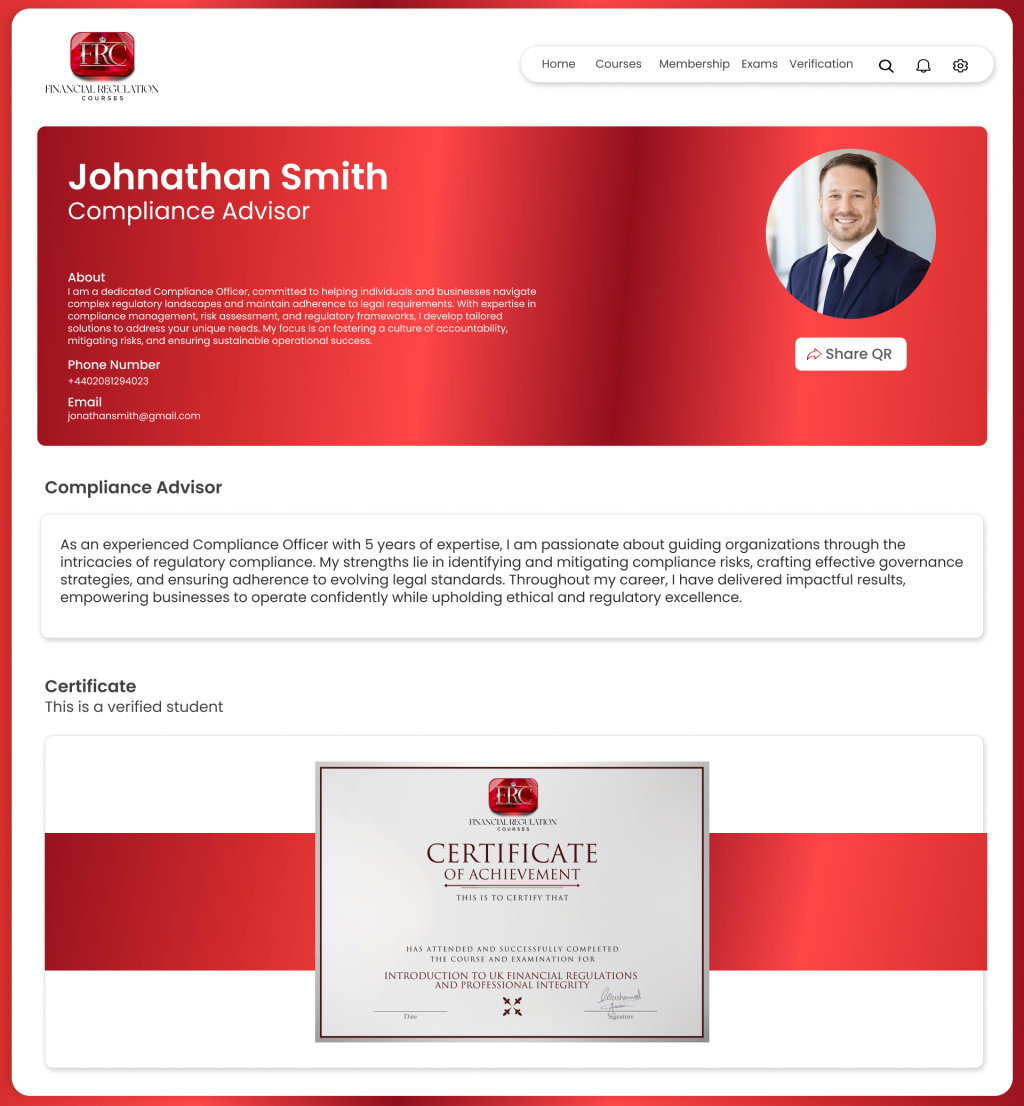

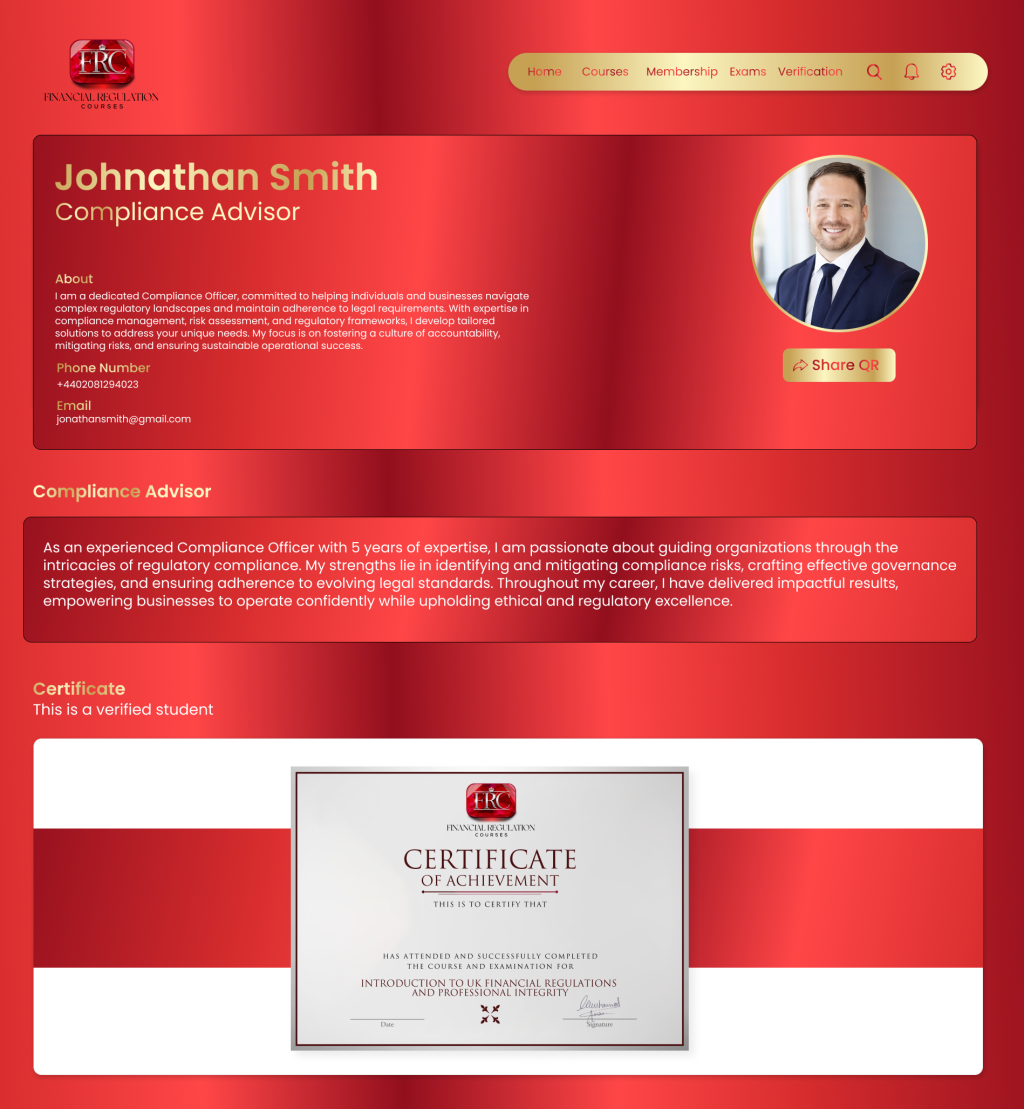

Sleek & Stylish Profiles For Our Students to Showcase Their Professionalism

Our Introduction to UK Financial Regulation and Professional Integrity course is designed to equip students with essential knowledge of ethical standards and regulatory frameworks in the UK financial industry. By completing this course, students not only gain in-depth insights into the key principles of financial regulation but also learn the importance of professional integrity, ethical decision-making, and whistleblowing in maintaining market integrity.

Students have the option to receive a sleek and stylish profile to showcase their professionalism as part of our Professional Membership. This profile highlights your newly acquired certifications, skills, and qualifications in a modern, easily accessible format, perfect for employers seeking top-tier talent. The professional digital profile serves as a valuable asset, allowing you to demonstrate your commitment to ethical conduct and regulatory knowledge—qualities that are highly valued in today’s financial sector.

With this polished digital presence, our students are well-positioned to stand out in the competitive job market. Whether advancing in their current role or seeking new opportunities, our profiles allow you to highlight your expertise and make a lasting impression. This powerful tool ensures that you’re not only seen as a certified professional but also as someone who understands the ethical responsibilities crucial to the integrity of the financial system.

Exam Fraud Prevention

At Financial Regulation Courses, the Introduction to UK Financial Regulation and Professional Integrity not only reflects your expertise in UK financial regulations, investment risk management and Introduction to UK Financial Regulation and Professional Integrity but also stands as a symbol of integrity and security.

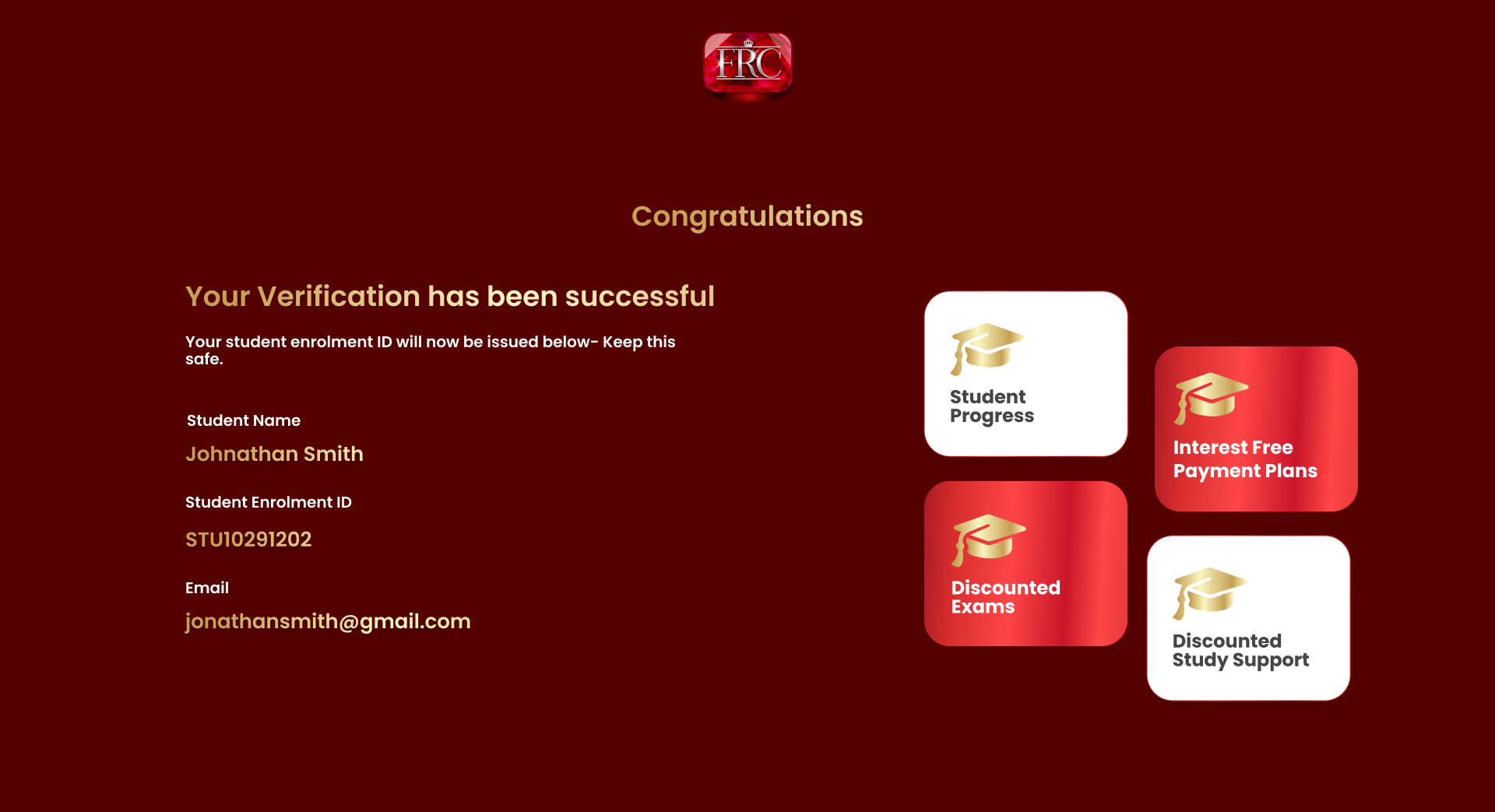

Our robust Know Your Customer (KYC) verification process ensures that only authenticated students are enrolled, safeguarding the value of this certification and upholding the highest industry standards.

The Introduction to UK Financial Regulation and Professional Integrity is designed to be fraud-proof, thanks to advanced verification protocols and exam monitoring technologies. This ensures that every certification earned represents genuine effort and knowledge, providing assurance to employers and financial institutions worldwide.

By completing the KYC process, students at Financial Regulation Courses demonstrate their commitment to ethical practices, reinforcing the credibility of their credentials. Employers can trust the authenticity of this globally recognised certification, knowing it reflects verified expertise and a dedication to professional excellence.

With fraud-proof certification measures in place, your Introduction to UK Financial Regulation and Professional Integrity is more than a credential—it is a testament to your integrity and a trusted hallmark of your capabilities in the competitive financial services sector.

"Integrity Ensured – Every Certificate Earned on Merit."

At Financial Regulation Courses, Authenticity Meets Excellence

At Financial Regulation Courses, we prioritise authenticity, integrity, and value in everything we do. Our commitment is to ensure that students gain genuine, verifiable CPD-accredited skills that meet the highest professional standards.

While we are not a formal qualification provider, our certifications stand apart due to their robust design, practical application, and relevance to today’s dynamic financial landscape. By focusing on what truly matters—practical expertise and ethical understanding—we empower both students and corporate partners to achieve their goals with confidence.

Our certifications and membership benefits are crafted to deliver value that resonates across industries. For students, this means advancing their careers with trusted credentials and gaining exclusive access to professional resources. For corporations, it means building teams equipped with ethical and well-rounded professionals who embody competence and accountability.

At Financial Regulation Courses, we’re not just offering certifications; we’re shaping futures and fostering trust in the financial world.

A Certification That Redefines Success

The Introduction to UK Financial Regulations and Professional Integrity is an invaluable certification designed to enhance the professional standing and career prospects of individuals at every stage of their journey in the financial services industry. Tailored to combine accessibility with rigorous content, this course equips participants with a deep understanding of UK financial regulations, ethical practices, and the skills necessary to thrive in regulatory and compliance-driven roles.

Whether you’re a graduate eager to enter the finance sector or an experienced professional aiming to strengthen your expertise, this certification offers a direct path to success. The course delves into critical areas such as regulatory compliance, ethical decision-making, and whistleblowing, equipping you with the tools needed to navigate complex financial landscapes with confidence.

For students opting into our exclusive paid membership services, we provide enhanced credibility through robust Know Your Customer (KYC) verification, ensuring that your credentials are trusted and verifiable. Additionally, our professional profiles highlight your achievements, creating an impressive showcase for prospective employers and clients alike.

By completing the Introduction to UK Financial Regulations and Professional Integrity, you’ll gain not only knowledge but also a respected certification that sets you apart in a competitive job market. This is your opportunity to solidify your commitment to ethical and professional excellence while enhancing your career trajectory in the ever-evolving financial industry.

Frequently Asked Questions

How Can I Enrol?

Enrolling in the Introduction to UK Financial Regulations and Professional Integrity course is simple and accessible for all financial professionals. Visit our official website: www.financialregulationcourses.com to start your journey today!

Are Exams on Fixed Dates?

With our advanced facial recognition software and biometric verification systems, combined with our KYC process to ensure exam integrity, our students have the flexibility to take their exams at any time, day or night, offering unparalleled convenience without compromising security or professionalism.

How do I get a Digital profile?

To access a digital profile, you must join our membership programme, which operates separately from course enrolment. For more information and to join, please visit our Membership Page.

How Much is the UK Regs?

For full pricing and student discounts, please visit Financial Regulation Courses.

Can I study at my own pace?

Yes this is a self paced learning programme designed to work around your existing schedule.

If I pay in full must I still do my KYC?

Yes, even if you pay for your course in full, you are still required to complete the Know Your Customer (KYC) process for exam verification. This mandatory step ensures the integrity and security of our certification programmes by verifying the identity of all candidates. The KYC process is essential to prevent exam fraud and maintain the high standards of our Certifications. Please note that the KYC verification must be completed personally by the student preparing for the exam; third-party payments are not accepted.

Open Doors to Career Opportunities: More Interviews, More Promotions

Stand out as a true professional in the dynamic world of investment banking. With our Professional Profile, showcase your expertise, achievements, and commitment to integrity, ethics, and professionalism of the highest standards.

Position yourself as an industry leader by demonstrating your dedication to ethical practices and excellence. Elevate your professional standing, build trust with employers, and unlock opportunities that set you apart in the competitive financial services landscape.

Redefine Professionalism in Finance—Your Guide to UK Regulations and Integrity

The Introduction to UK Financial Regulations and Professional Integrity equips you with the critical skills and knowledge to navigate the complex and ever-changing regulatory landscape of the UK financial sector. This course is designed to help you maintain the highest ethical standards while excelling in roles that demand meticulous attention to detail and unwavering credibility.

In a sector where compliance and ethical conduct are paramount, understanding the principles of professional integrity is not just a requirement—it is a cornerstone of long-term success. This course provides a comprehensive understanding of the UK’s regulatory framework, empowering you to confidently interpret and apply financial regulations to real-world scenarios. You’ll explore key topics such as whistleblowing, anti-money laundering (AML) protocols, and the significance of transparency in fostering trust within the industry.

Beyond regulations, the course delves into the practical aspects of ethical decision-making, helping you identify and address moral dilemmas that may arise in your professional journey. You’ll learn how to act with integrity under pressure, ensuring you contribute positively to market stability and uphold the reputation of your organisation.

Whether you’re an aspiring financial professional or a seasoned expert seeking to solidify your understanding of UK financial regulations, this course provides the knowledge and tools needed to thrive. By mastering these principles, you’ll not only enhance your career prospects but also demonstrate your commitment to building a credible and ethical financial services industry.